2 of the Factors That Impact Mortgage Rates

2 of the Factors That Impact Mortgage Rates If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Over the last couple of years, they hit record lows, rose dramatically, and are now dropping back down a bit. Ever wonder why? The answer is complicated because there’s a lot that can influence mortgage rates. Here are just a few of the most impactful factors at play. Inflation and the Federal Reserve The Federal Reserve (Fed) doesn’t directly determine mortgage rates. But the Fed does move the Federal Funds Rate up or down in response to what’s happening with inflation, the economy, employment rates, and more. As that happens, mortgage rates tend to respond. Business Insider explains: “The Federal Reserve slows inflation by raising the federal funds rate, which can indirectly impact mortgages. High inflation and investor expectations of more Fed rate hikes can push mortgage rates up. If investors believe the Fed may cut rates and inflation is decelerating, mortgage rates will typically trend down.” Over the last couple of years, the Fed raised the Federal Fund Rate to try to fight inflation and, as that happened, mortgage rates jumped up, too. Fortunately, the expert outlook for inflation and mortgage rates is that both should become more favorable over the course of the year. As Danielle Hale, Chief Economist at Realtor.com, says: “[M]ortgage rates will continue to ease in 2024 as inflation improves . . .” There’s even talk the Fed may actually cut the Fed Funds Rate this year because inflation is cooling, even though it’s not yet back to their ideal target. The 10-Year Treasury Yield Additionally, mortgage companies look at the 10-Year Treasury Yield to decide how much interest to charge on home loans. If the yield goes up, mortgage rates usually go up, too. The opposite is also true. According to Investopedia: “One frequently used government bond benchmark to which mortgage lenders often peg their interest rates is the 10-year Treasury bond yield.” Historically, the spread between the 10-Year Treasury Yield and the 30-year fixed mortgage rate has been fairly consistent, but that’s not the case recently. That means, there’s room for mortgage rates to come down. So, keeping an eye on which way the treasury yield is trending can give experts an idea of where mortgage rates may head next. Bottom Line With the Fed meeting later this week, experts in the industry will be keeping a close watch to see what they decide and what impact it’ll have on the economy. To navigate any mortgage rate changes and their impact on your moving plans, it’s best to have a team of professionals on your side.

20702 Mandalay Ct. Ashburn VA 20147

Get ready for the perfect blend of comfort and convenience! Coming soon, don't miss the opportunity to explore this meticulously maintained single-family home nestled on a tranquil Cul-de-sac, offering proximity to restaurants, shops, and transit in Ashburn Village. This stunning 5-bed, 3.5-bath residence with a two-car garage boasts a seamless fusion of modern amenities and timeless charm. Hardwood and LVP flooring grace the entire home, creating an inviting ambiance. The updated and expanded kitchen, adorned with stainless steel appliances, granite countertops, and chic white cabinets, flows into the dining room featuring a gas fireplace—an ideal spot for cozy gatherings. The laundry room adds practicality with built-in cabinets, countertop, and tile flooring. The primary bedroom is a retreat with a full wood accent wall, a spacious walk-in closet, and an ensuite that exudes luxury with a double vanity and quartz countertop, a soaking tub, and a generously sized shower. Stately molding and wainscoting throughout add a touch of elegance. Convenient living extends to the fully fenced backyard and the new Trex deck accessible from the living room—an excellent space for relaxation and entertaining. Explore the wealth of community amenities in Ashburn Village, including walking paths, indoor and outdoor pools, soccer fields, tennis courts, and playgrounds. The location offers easy access to major roads such as Route 7, Route 28, and the Dulles Toll Road. For more details, reach out to Nikki Ryan at (703) 615-2663 or Annie Cefaratti at (202) 841-7601. Your dream home awaits!

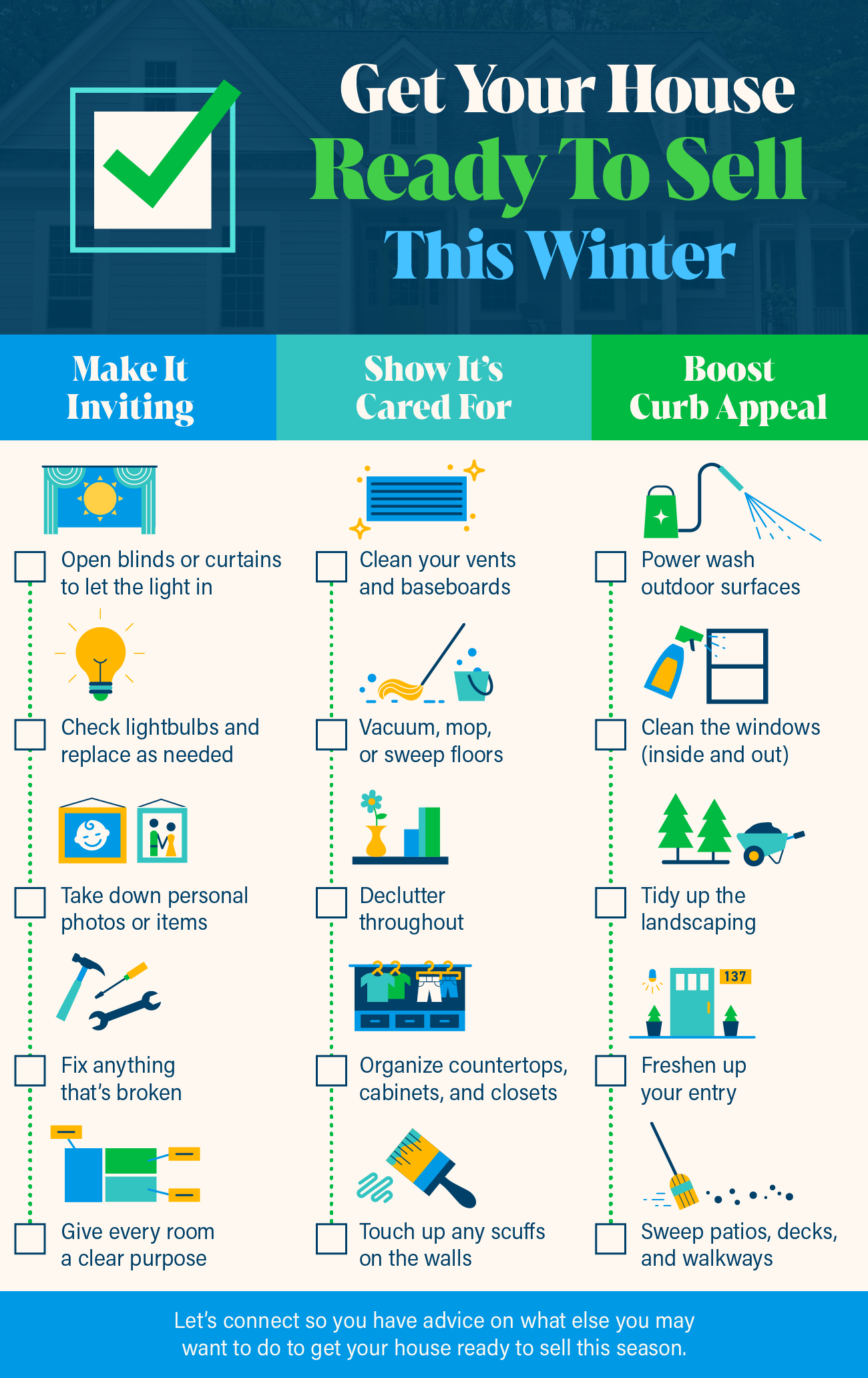

Get your house ready to sell this winter

Get Your House Ready To Sell This Winter [INFOGRAPHIC]

Categories

Recent Posts